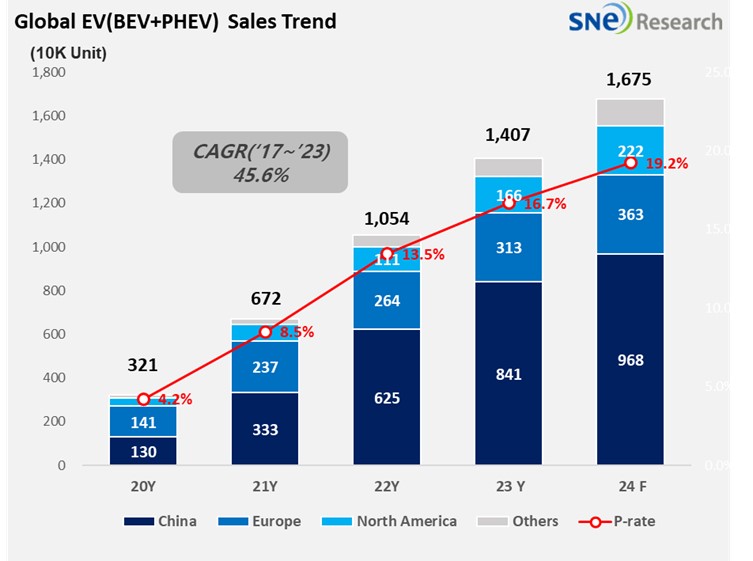

Global[1] Electric Vehicle Deliveries[2] in 2024 Expected to Reach 16.75 Mil Units,

a 19.1% YoY Growth, and See Slowdown in Sales

(Source: 2024 1Q Global EV & Battery Quarterly Forecast, SNE Research)

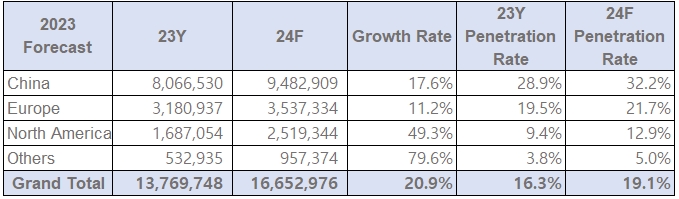

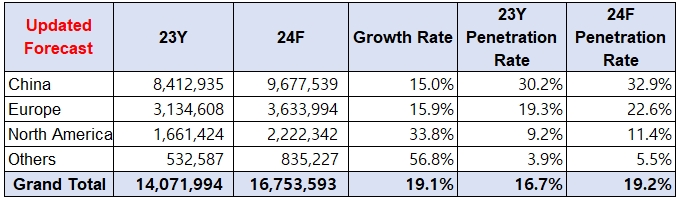

The total number of electric vehicles registered in countries around the world in 2023 was approximately 14.07 million units. This is 300kunits higher than the previous forecast made in H2 2023 (13.77 million units), and the yearly growth rate compared to 2022 was upwardly modified from 30.6% to 33.5%. In 2024, 16.75 million units of electric vehicles are expected to be sold, recording a somewhat decelerated growth of 19.1%.

(Source: 2024 1Q Global EV & Battery Quarterly Forecast, SNE Research)

The reason for upward modification, particularly focusing on China, was that, although the market has seen a slowdown in growth compared to the last year, high growth momentum was maintained by local companies – BYD and SAIC – in China in the latter half of 2023. Particularly, BYD recorded 88% of growth in PHEV thanks to its price reduction strategy, selling 8.41 million units in 2023 which exceeded the predictions. However, in 2024, BYD is forecasted to post a relatively low growth of 15% and sell 9.68 million units due to the overall economic downturn and market saturation in China.

In Europe, where EV subsidies have reduced and carbon emission regulations have tightened, the market growth also seems to experience a slowdown with 15.9% of growth in 2024. The EV sales in Europe is forecasted to expand from the end of 2024 in order to meet the requirements of carbon emission regulations that are going to strengthen from 2025.

Despite weakened consumer confidence due to increases in interest rates, the EV market in North American region showed a high growth of 49% in 2023. Till the first half of 2024, the North American EV market is expected to post 33.8% of growth, lower than the previous forecast as the interest rates are still high and market players may need time to get used to the IRA regulations. The local companies in the North America are naturally forecasted to enjoy a strong upward momentum thanks to the IRA, and as the interest rates are expected to freeze after the first half of 2024, the consumer confidence may rebound in the latter half of this year.

A slowdown in the EV market was aggravated by several reasons; fluctuations in energy prices, issues rising from overheated competition such as shortage of charging infrastructure, accumulation of inventory in line with explosive growth in the market, and less impacts of potential demand from the pandemic to 2023. In addition, eco-friendly policies of each country have not been firmly established yet, and the effectiveness of those policies are uncertain either. The year of 2024 is expected to be time for market players to catch their breath while those uncertain factors shape themselves by untangling the complicated issues around them. From the mid to long term perspective, though, the electric vehicle market is expected to continuously see a growth down the road.

[1] The xEV sales of 80 countries are aggregated.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers and registered during the relevant period.